Business Knowledge For It In Trading And Exchanges Pdf Viewer

The expertise of the trading companies tends to lie in the market knowledge, offering its customers specific political, cultural or linguistic capabilities. Both small and large firms may choose to work with trading companies. Whereas small firms may choose to use a trading company due to not having the capacity to get to know the.

- Business Knowledge For It In Trading And Exchanges Pdf Viewer App

- Market Microstructure

- Business Knowledge For It In Trading And Exchanges Pdf Viewer Free

What is 'Online Trading' Online trading is simply buying and selling assets through a 's internet-based proprietary trading platforms. The use of online trading increased dramatically in the mid- to late-'90s with the introduction of affordable high-speed computers and internet connections. Stocks, bonds, mutual funds, ETFs, options, futures, and currencies can all be traded online. Also known as e-trading or self-directed investing. BREAKING DOWN 'Online Trading' Traditionally, investors and traders have to call their to make a trade for them.

If John wanted to purchase 50 shares of Intel, he would call his broker with a buy order request. The broker would let John know the and confirm the purchase order. If the investor is making a, the broker has to confirm the limit price, how long to keep the order open for, what account to purchase the shares in (if John has multiple investment accounts), etc. The investment representative must also confirm the for making the trade. When all has been established, the broker would place the trade in the system which is linked to and, such as the (NYSE) or the.

The client would receive a trade confirmation by mail and a monthly or quarterly statement of account showing a list of his investments. If John wanted to transfer some cash from his to his checking account, and vice versa, he would also have to call in to make that transaction request.

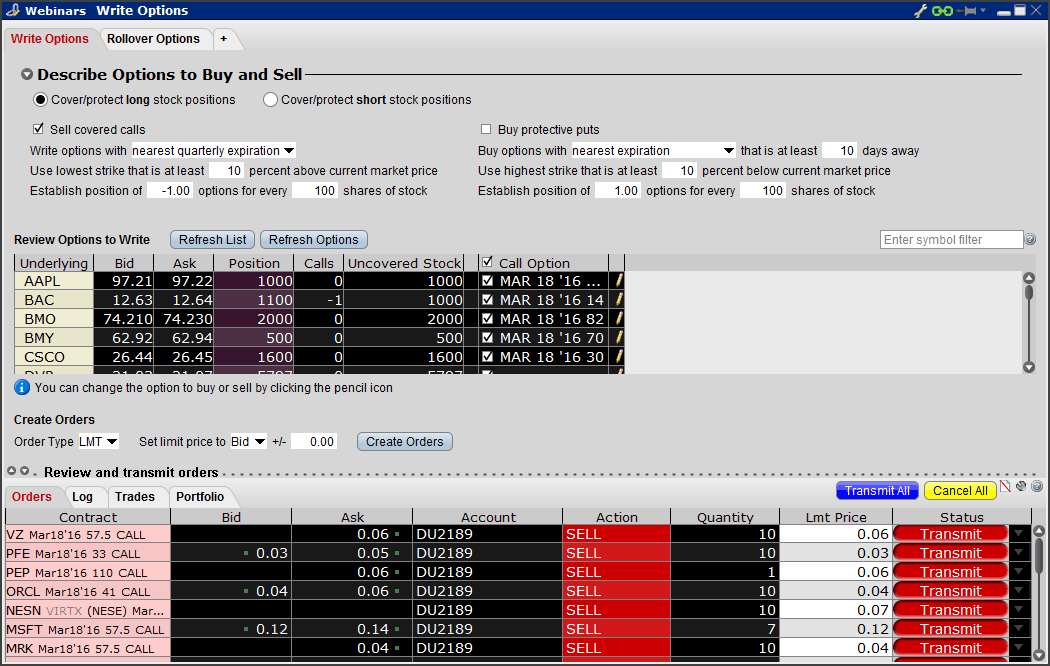

Today, with the advent of the internet in the digital era, more and more investors are using offered by their brokers for DIY (do-it-yourself) investing. The online trading platforms serve as a hub with multiple tools for the investor or trader. The investor can place buy and sell orders; place market, limit, stop, stop-loss, and stop-limit orders; check the status of an order; view real-time stock quotes; read news on companies; view the list of securities currently held through the dashboard; etc.

Business Knowledge For It In Trading And Exchanges Pdf Viewer App

An investor can also access his or her investment statements, confirmation statements, and investment tax forms using the online system. Most that are affiliated with banks also provide added convenience for their digital clients by linking their bank accounts to their investment accounts. This way, an investor can easily initiate a transfer between accounts held under the same financial institution.

The advent of online trading has reduced costs for both investors and discount brokers. To encourage people to do their investing themselves, brokers have lower commissions for trades placed online than for trades placed over the phone with a representative.

It is not uncommon to pay somewhere between $4.95 to $9.99 for an online trade; same trade which would cost about $29.99 if made over the phone. The lower fees have also made the accessible to a wider range of people who may not have been able to afford the higher commission fees of a personal advisor or over-the-phone trade.

Market Microstructure

As brokers transition into automated trading, they save costs on their ends from hiring fewer human representatives. Another benefit of online trading is the improvement in the speed of which transactions can be executed and settled, because there is no need for paper-based documents to be copied, filed and entered into an electronic format. When an investor enters an order online, the order is placed in a database which checks for the best price by searching all the that trade the stock in the investor's preferred currency. The exchange with the best price matches the buyer with a seller and sends the confirmation to both the buyer’s broker and the seller’s broker. All this is done within seconds of placing a trade, compared to making a phone call which has to go through several confirmation steps before the rep can enter the order.

Business Knowledge For It In Trading And Exchanges Pdf Viewer Free

It is up to an investor or trader to do his on a broker before opening an online trading account with the company. Before an account is opened, the client will be asked to fill out a questionnaire about his or her investment and financial history to determine what type of trading account is suitable for the client.

If the investor has little knowledge about the different types of securities and trading strategies in the financial world, a simple will be opened for him for doing simple buy and sell orders on stocks, mutual funds, bonds, and ETFs. On the other hand, a sophisticated trader who would like to implement various trading techniques will be given a in which he can buy, short, and write securities such as stocks, options, futures, and currencies. Not all securities are available to be traded online, depending on your broker. Some brokers require that you call them to place a trade on any stocks trading on the and select stocks trading.

Also, not all brokers facilitate derivatives trading in commodities and currencies through their online platforms. For this reason, it is important that the trader understands what a broker offers before signing up with the trading platform.

The Athens Exchange Group (ATHEX) is a group of companies that provide support to the Greek Capital Market and promote the investment culture in Greece. The site provides information about various market models, financial products that are listed and traded, and information about companies listed on ATHEX. In addition, the site contains information about ATHEX's various operations, regulatory information, and services. The site provides press releases, company announcements, publications and reports, and market data. The Qatar Stock Exchange aims to support Qatar's economy by giving investors a platform through which they may trade in a fair and efficient manner. This website provides useful tools for those looking to invest in Qatar such as economic indices, exchange news, events, regulations and instructions, and links to various regional markets. Financial documents from Qatar-based companies are provided in the 'listed securities' portion of the website. Some parts of the site may only be viewed by registering for a free membership.

The Bolsa de Madrid, or Madrid Stock Exchange, is a market that trades a range of products and also serves as a meeting point for companies and investors. The Madrid Stock Exchange strives for the further development of the Spanish economy, a greater majority of productive investments, and an increase in overall wealth. The Bolsa de Madrid website lists markets and prices, companies, indices, shares, exchange-traded funds, warrants, and investment funds. The site also contains publications and statistics, as well as studies and reports. This resource is the official website of the Zimbabwe Stock Exchange. The stock exchange's three core functions include: providing a critical link between companies that need funds to set up new businesses or to expand their current operations and investors, providing a regulated market place for buying and selling of shares, and providing a properly constituted and regulated environment that ensures market integrity and fairness. The site contains a company directory, stock-related news articles, and market data.